Understanding State-Level Budget Forecasting

State-level budget forecasting is a critical process that involves estimating future revenues and expenses to inform financial planning and resource allocation. By anticipating potential financial scenarios, state governments can effectively allocate resources, adjust spending priorities, and maintain fiscal responsibility. This process plays a pivotal role in ensuring that states can meet their financial obligations and support public services, including education, healthcare, and infrastructure.

Traditionally, budget forecasting has relied on methods such as historical data analysis and the utilization of key economic indicators. Historical data provides insights into past spending patterns and revenue flows, allowing policymakers to make educated predictions about future trends. Furthermore, economic indicators, including employment rates, inflation rates, and GDP growth, serve as essential tools in assessing the overall health of the economy and its implications for state budgets. By analyzing these variables, state financial officials aim to create budgets that are not only realistic but also responsive to emerging economic conditions.

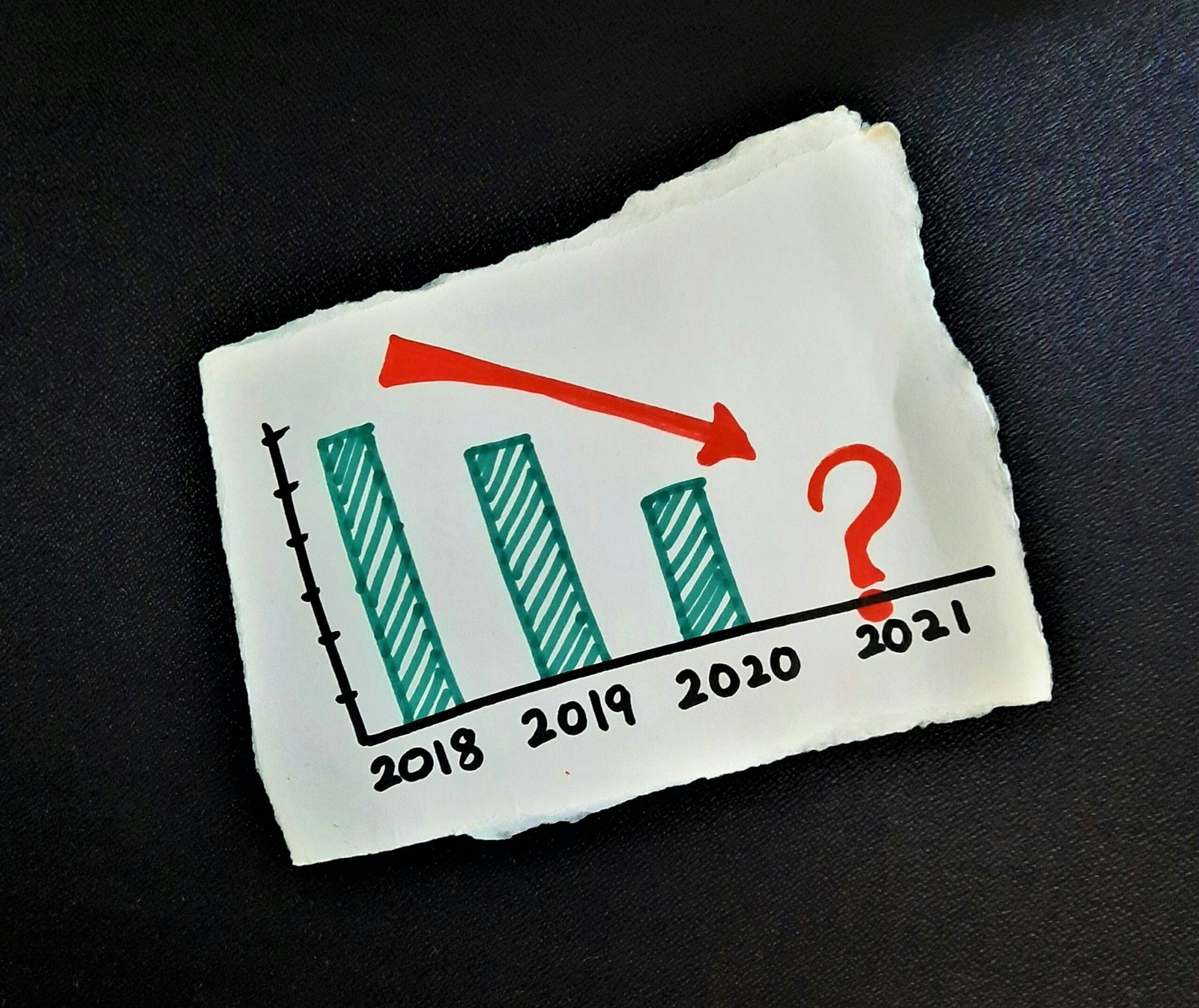

However, conventional approaches to budget forecasting face several challenges and limitations. One significant issue is the accuracy of forecasts, which can be hampered by unforeseen events, such as economic downturns or natural disasters. Furthermore, the traditional methods may struggle to keep pace with rapid changes in the economic landscape, making it difficult for states to react in a timely manner. This lag in responsiveness can lead to budgetary shortfalls and misallocation of resources, ultimately affecting essential services provided to the public.

As economic environments become increasingly volatile, it becomes imperative for state governments to seek innovative solutions to enhance their forecasting capabilities. This necessity sets the stage for the exploration of advanced technologies, such as artificial intelligence, which hold the potential to revolutionize state-level budget forecasting.

The Role of Artificial Intelligence in Budget Forecasting

Artificial Intelligence (AI) has emerged as a transformative force in various sectors, and its role in state-level budget forecasting is increasingly significant. By harnessing advanced technologies such as machine learning and predictive analytics, governmental fiscal management can be significantly enhanced. These AI algorithms can analyze vast datasets, identifying trends and patterns that may not be immediately apparent to human analysts. This capability allows for the production of more accurate and reliable budget forecasts.

Machine learning, a subset of AI, enables algorithms to learn from historical data and refine their predictions over time. For instance, by examining past expenditure patterns, machine learning models can adjust for seasonal fluctuations and economic changes, making it possible to generate forecasts that are both timely and relevant. Similarly, predictive analytics can assess various data points, such as historical trends, demographic shifts, and economic indicators, to predict future revenue and expenditure outcomes with greater precision.

Several successful implementations of AI in government budgeting underscore its potential. For example, the city of Los Angeles adopted AI-driven analytics to forecast expenditures related to public safety. By analyzing crime data alongside spending patterns, the city was able to reallocate resources more efficiently, resulting in a notable increase in public safety outcomes. Additionally, the state of Arizona has embraced AI tools for revenue forecasting, leading to improved accuracy in predicting income from taxes. These examples illustrate not only the practical benefits of incorporating AI into budget forecasting but also how these technologies can foster a more proactive fiscal management approach.

Ultimately, the integration of AI into budget forecasting represents a paradigm shift. The sophisticated data analysis capabilities of artificial intelligence can lead to better-informed fiscal decisions, thus enhancing the efficiency and accuracy of public budget management systems. As states continue to navigate complex financial landscapes, AI stands out as a promising solution to improve overall budgetary processes.

Benefits of Integrating AI in Budget Forecasting

In recent years, the integration of Artificial Intelligence (AI) in budget forecasting has revolutionized the methods by which state governments approach fiscal management. One of the primary benefits of AI is its capability to enhance accuracy in predictions. Traditional budgeting processes often rely heavily on historical data and human judgment, which can lead to errors and inconsistencies. In contrast, AI algorithms analyze vast datasets, including economic indicators, demographic trends, and previous budget allocations, allowing for more precise forecasts. This improved accuracy enables state officials to make more informed financial decisions, reducing the risk of budget shortfalls and ensuring that resources are aligned with actual needs.

Speed is another significant advantage of employing AI in budget forecasting. By automating time-consuming tasks such as data gathering and preliminary analysis, AI tools can deliver forecasts in real-time. This rapid processing capability allows state agencies to respond more promptly to changing economic conditions, which is crucial in maintaining fiscal stability. When unforeseen events occur, such as economic downturns or unexpected expenditures, AI enables quicker reassessment and adjustments to the budget, ensuring that states remain agile in their financial planning.

Moreover, enhanced responsiveness to economic shifts is a key benefit of AI integration. AI systems can continuously monitor economic trends and incorporate live data inputs, making it easier for budget planners to adapt to fluctuations in revenue or expenditures. This proactive approach allows for strategic resource allocation, maximizing the efficiency of public funds and ensuring that they are directed where they are most needed.

Finally, AI plays a pivotal role in simulating various fiscal scenarios, equipping state officials with crucial insights for decision-making. By analyzing different possible futures based on a variety of parameters, AI assists in understanding potential outcomes of various fiscal policies. This capability provides state governments with a solid foundation for making well-informed, strategic decisions that ultimately govern their budgetary practices.

Challenges and Considerations in Adopting AI for Budget Forecasting

The integration of artificial intelligence (AI) technologies in state-level budget forecasting is fraught with challenges that can complicate implementation. One of the foremost issues is the quality of data. AI systems rely heavily on accurate and comprehensive data to generate reliable forecasts. However, many state governments may grapple with outdated or incomplete data sets, which can lead to erroneous projections and ultimately undermine fiscal management efforts.

Furthermore, the successful deployment of AI necessitates a workforce equipped with the requisite skills. The shortage of personnel trained in AI and data analytics is a significant barrier that states must overcome. Training existing employees or recruiting new talent can be resource-intensive, potentially straining state budgets further. As AI continues to evolve, there is also a pressing need for ongoing education and skill development, ensuring that personnel can adapt to new tools and methodologies.

Another critical consideration is the potential for biases embedded within AI algorithms. If historical data reflects systematic inequalities or errors, AI systems may inadvertently perpetuate these biases, leading to skewed budget forecasts that may not adequately serve all constituents. To mitigate this risk, it is essential for state governments to engage in rigorous analysis of their data inputs and to actively seek out diverse data sources that can help create a more balanced forecasting model.

Transparency and public trust are key elements in the successful implementation of AI in budget forecasting. State governments must establish clear communication regarding how AI-generated forecasts are developed and employed. Engaging with the public and stakeholders will foster a collaborative environment, allowing for greater scrutiny and, consequently, increased trust in the outcomes produced by AI systems. By addressing these challenges head-on, states can better harness AI’s potential in fiscal management.